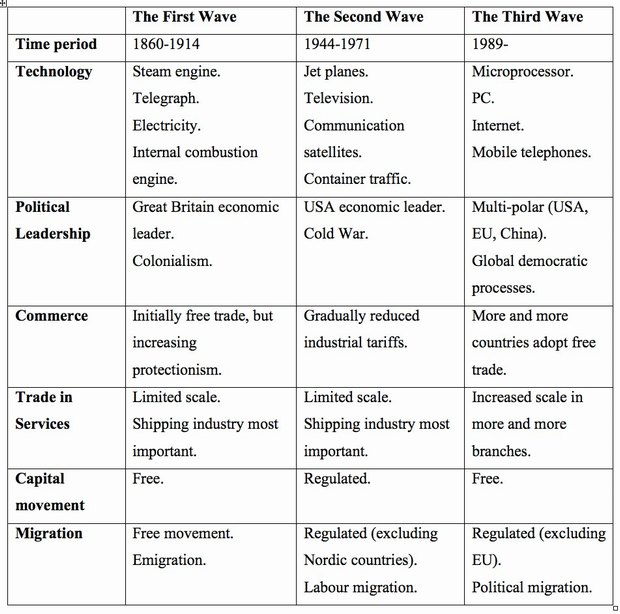

The First Wave

From 1860-1914 Europe and North America were strongly affected by internationalisation. The flow of goods accelerated. Capital moved relatively freely between countries. In some respects financial integration was more pronounced than it is today. Even international migration was greater than it is today. Roughly 60 million people left Europe to seek their fortunes in the New World.

Important drivers behind this wave of globalisation were both the new technology of the era that could bridge long geographical distances and the fact that many countries began to embrace liberal trade policy after years of protectionism. During the period 1500-1800, world trade increased by about 1 percent per year. After 1820 it increased by 3.5 percent and during the nineteenth century as a whole, trade in Europe increased by 40 percent.

Great Britain was the world's leading economy. The basis for the European free trade system was the 1860 free trade pact between Great Britain and France. Many other European countries subsequently aligned themselves with this free trade system.

Great Britain had introduced the gold standard in 1816, which meant that their currency gained a stable value in relation to gold. During the nineteenth century the English pound sterling was the generally accepted currency of international business and many other countries introduced the gold standard.

Sweden and Denmark established a monetary union based on the gold standard and with the kronor as the monetary unit. Two years later Norway joined the Scandinavian monetary union. The kronor had the same value in all three Scandinavian countries and the currency in each of the countries could be used interchangeably in daily transactions.

The Second Wave

International regulations and organisations to support economic integration at the global level were created after World War II. Cooperation was based on the Bretton Woods Agreement of 1944.

The USA was now the leading economy in the world and the dollar became the monetary basis of the financial system. The 'Bretton Woods system' meant that nations had fixed currency exchanges in relation to the US dollar, which in turn was fixed to the gold standard.

In an important aspect, the post World War II international economy was less open than the period prior to World War I. Before World War I the international flow of capital had been free. The Bretton Woods system was based on governmental control of the international flow of capital.

Two organisations were established during this period, the World Bank (IBRD) and the International Monetary Fund (IMF). In addition a special agreement, the General Agreement on Tariffs and Trade (GATT) became operative in 1948. In practice GATT became the international organisation which set the framework for several important steps towards increased global free trade, particularly via successive reductions in industrial tariffs.

But by 1970 the Bretton Woods system was coming under increasing pressure. The primary reason for this was the escalating cost of the Vietnam War and of the 'Great Society' social reform programme which led to a US budget deficit and to inflation.

In 1971 the US President Richard M. Nixon "closed the door" on the gold standard and the first devaluation of the dollar come a year after. The post-war international currency system was then further shaken by the oil crisis of 1973.The Third Wave

Since the 1970s the cost of processing, storing and transferring information has decreased dramatically, thus creating new possibilities for international trade and business.

In addition, political trade barriers have been relaxed in many ways. The World Trade Organization (WTO) was established in 1995 and capital has again become more elastic.

The more populous countries in the developing world, particularly China and India, have opened their doors to the world. European cooperation has widened and deepened. The fall of the Berlin Wall in 1989 can be seen as a suitable starting point then for the third wave of globalisation.

In the last few decades, international trade has grown significantly faster than total production. The export of goods amounted to 31 percent of global GDP in 2006 as compared to 12 percent in 1970. Foreign direct investment (establishing or buying up companies abroad) has increased twice as fast as trade. An even more rapid increase has been seen in foreign securities (investments that do not lead to controlled ownership in foreign companies).

We are now in a truly exciting phase of global economic development. Globalisation gives rise to a number of new business potentials. But business potentials are not discovered in the same way as one discovers a mineral deposit. Rather business possibilities are created in the way that one creates a work of art – by combining a range of variables in a unique manner.

The only thing that we can say for certain about the future's most successful international entrepreneurs is that we certainly cannot know what they will build their business ideas upon.

By Anders Johnson, writer and author of the work "Globaliserings tre vågor" (in Swedish). - www.regeringen.se/globaliseringsradet