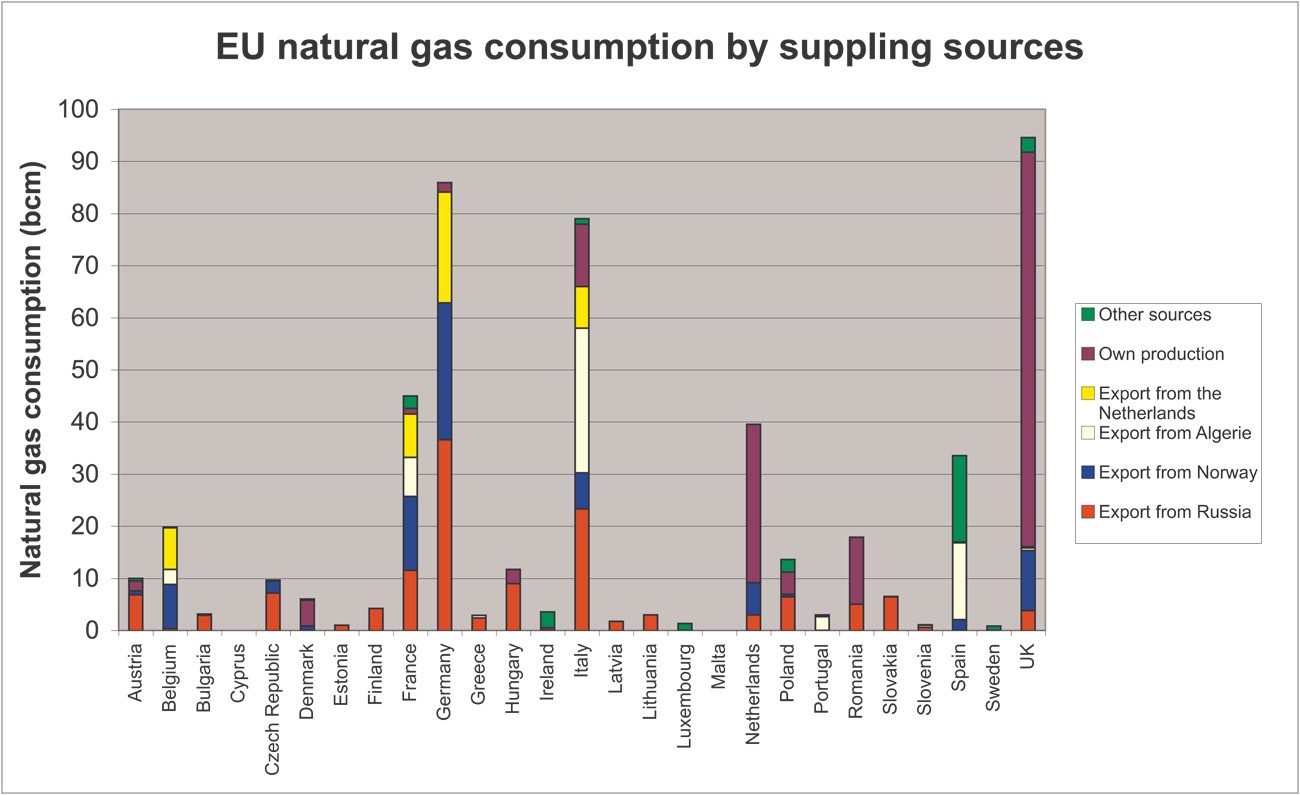

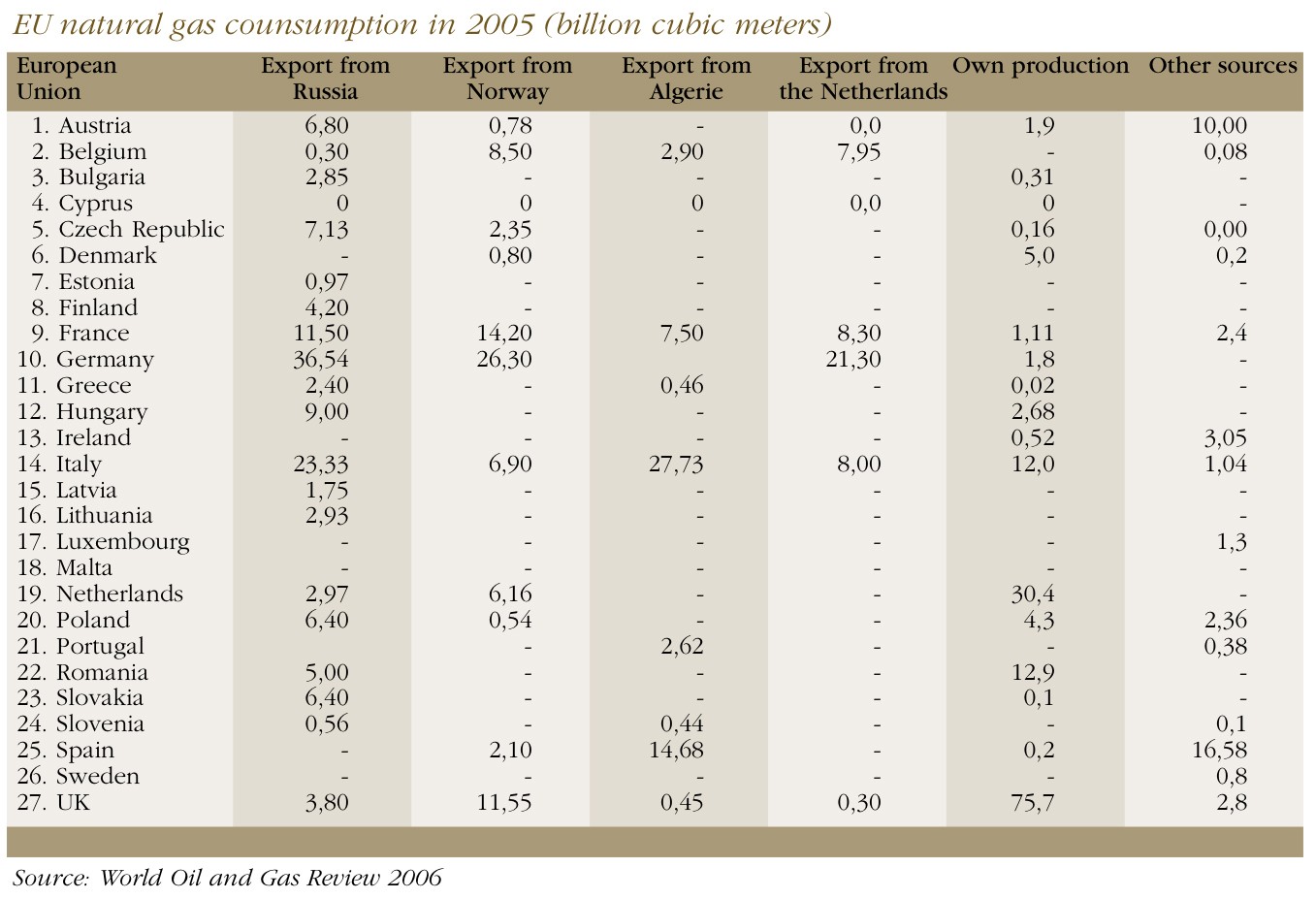

The European Union is highly dependent on the import of natural gas from Russia. 60% of all the gas consumed in the EU is imported, and 46% of the EU's gas imports come from Russia. Russia exports natural gas to 19 EU countries. In certain EU members, namely, Bulgaria, the Czech Republic, Estonia, Finland, Latvia, Lithuania and Slovakia, Russia almost provides the entire amount of gas imported. Among these countries, Finland, at 14%, has the lowest share of natural gas in its total energy usage while in Slovakia natural gas accounts for almost 30% of total energy consumption. Countries that satisfy more than half of their demand need with Russian gas make up some 16% of the EU's population while 60% of the EU's population live in countries where Russia satisfies more than 25% of gas demand. Spain is currently the only large gas consumer in the EU that does not import natural gas from Russia.

Stable and predictable gas supplies from exporters are important for import dependent Europe. Lately however Russia has twice acted in such a way as to question its reputation as a reliable natural gas supplier to the European Union. In January 2006 the Russian-Ukrainian gas price conflict disrupted gas supplies to some parts of Europe for several days. In January 2007 a similar gas price conflict between Russia and Belarus briefly affected Russian oil supplies to some EU countries.

Russia has clearly demonstrated how its abundant natural gas resources can be turned into a handy instrument of political leverage. As such then the reduction of Europe's dependence on Russian natural gas is becoming a crucial issue in EU energy security policy.

The EU's own gas production comes mainly from the UK and the Netherlands who together control much of the gas resources of the North Sea. Gas production in both countries has however already reached its peak and is now thought to be declining. Gas consumption in Europe is steadily growing however and is expected to continue rising for the forseeable future. Natural gas is a very attractive substitute for oil since it is less carbon intensive compared to oil and coal. The Kyoto agreement and the EU's own requirements to reduce CO2 emissions will put stronger pressure on the industry to use more natural gas instead of oil and coal. The natural pace of economic growth in the EU is another factor that will increase natural gas demand in terms of absolute volumes.Therefore, Europe's continuing dependence on Russian gas suppliers is likely to become ever more problematic in the future. Access to a wider range of suppliers is needed to reduce Russian dominance in the European gas market.

Norway and Algeria are two of the other main suppliers of natural gas to the EU. Indeed, both of these countries have almost doubled their gas exports to the EU over the last ten years and each has the potential for further export growth.

The shares of Norwegian and Algerian gas consumed in the EU increased from 7% and 8% respectively in 1995 to 16% and 12% in 2005. Nevertheless, Norwegian and Algerian gas resources are several times smaller than those owned by Russia while neither of these countries has sufficient supply potential to significantly threaten the Russian position as the largest gas exporter to the EU.

On the other hand, the recent technological developments that have reduced the price of liquefied natural gas (LNG) enable Europe to diversify its energy supply sources and to import natural gas more easily from the African and Middle Eastern countries (Egypt, Libya, Nigeria, Qatar, Yemen, Iran, the UAE and Oman) plus Latin-American Trinidad and Tobago, which are rich in fossil fuels. LNG technology enables natural gas to be condensed into liquid form and then transported by tankers.

Today the largest part of Europe's LNG supply comes from Algeria. The ability to supply a greater volume of LNG to the European market from other LNG suppliers is however constrained by the lack of import terminals for LNG re-gasification in Europe. Due to their close proximity to LNG exporters, France, Spain and Italy have the largest LNG import capacities, including both those currently operating and those under construction. These countries' supply sources have historically been the most diversified in Europe.

Several other countries, including Germany, Poland, Latvia and Romania that are currently rather dependent on Russian gas supply, have however recently considered constructing LNG import terminals.

The cost of supplying LNG is higher than that of supplying gas via pipelines. In addition, political uncertainty in the Middle East and North Africa ensures that Russian gas remains, at present, more attractive for many EU members, while the reality remains that the future European gas market would be unthinkable without Russian suppliers. Nevertheless, the availability of several potential gas suppliers for each particular country in the EU would however challenge the current market dominance of Russian gas on the European gas market.

Click to view larger image.

Click to view larger image.

By Marina Tsygankova, Senior Executive Officer, Statistics Norway - www.ssb.no