Overseeing Europe´s gas supply at Gazprom´s Headquarters in Moscow. Photo: Mikhail Metzel - AP

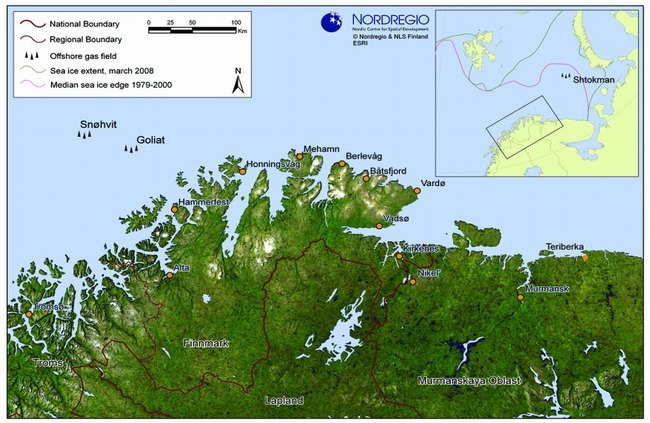

In the High North, it is primarily the development of the large Russian Shtokman gas-field, close to the island of Novja Semlja in the Barents Sea that has been delayed.

Originally the plan was to begin production here in 2013. Early February this year the companies involved, namely, Shtokman Development jointly owned by Gazprom, Total and Statoil, announced that they are now planning to begin production in 2016 at the earliest. Many observers however think that a start date of 2020 is more likely.

One of the major reasons for the slowdown relates to the technical problems which need to be solved before production can begin in the cold Arctic waters. In addition, uncertainty in terms of future wholesale gas prices on the world market has also had a major impact – particularly in respect of investment decisions.

What implications will these delays have on jobs? When Statoil started producing LNG (Liquid Natural Gas) from the Snøhvit-field the decision was taken to produce more or less onshore on the island of Melkøya just outside the town of Hammerfest. This generated high incomes during the construction phase but only some 300 jobs on a more permanent basis. (See Journal 3/2008 for more details.)

Shtokman, which is a much larger field than Snøhvit will most likely concentrate on off-shore production. Still the installations represent major opportunities both in Northern Russia and in the county of Finnmark in Norway, particularly in respect of service sector employment. In Russia the town of Teiberka as well as the city of Murmansk have great expectations in this regard while in Norway the towns of Kirkenes and Vardø hope to join in this gas bonanza.

Both in Norway and in Russia population levels in the high north are declining mainly because of the lack of jobs which forces people to move away in search of work. The fishing industry, mining and military activities which for decades were the backbone of the economy in these harsh areas, are all in decline.

Will the development of oil and gas production change this? To some extent yes. But if truth be told not significantly as the new jobs created are just too few in number. This is also the argument of Peter Arbo and Bjørn Hersoug at the University in Tromsø, who have studied the likely impacts in great detail (in Norway's Plan magazine No 1/2010). They argue that the number of jobs created will be fewer than those lost in the fishing industry.

Russia is the world's largest producer of gas. Millions of EU citizens are also completely dependent on Russian gas for heating and cooking. The sale of gas to these countries also generates significantly higher profits than selling it in Russia itself or to countries which used to members of the Soviet Union.

For several years now this increasing dependence on Russian gas has been an issue high on the European political agenda. A couple of years ago some Swedes also took the initiative to try to stop or at least move Nordstream, a 1220 km long new pipeline through the Baltic Sea, designed to transport gas from Siberia to Western Europe.

These protests seem however to have subsided while the first of the large tubes (approximately 1.5m in diameter) for the pipeline are now being transported from the small village of Slite on Gotland out to their future location. If targets are met within a year or so even more Russian gas will reach Western Europe.

Most gas in Russia

Some 70 countries in the world produce gas. Russia is the largest provider producing some 654 billion m3 annually followed by the USA with 546, the EU 198, Canada 187, Iran 112 and in sixth place Norway with 100.

The overview of proven gas reserves lists 100 countries including those in the EU. Again it is Russia on top, but now really in a class of its own with more than a quarter of all known reserves, 44 out of the total of 175 trillion m3. (1 trillion m3 = 1,000,000,000,000 m3).

Other countries with large reserves include Iran 27 and Qatar 26. The USA has 6 and Norway 2.2, a bit less than the European Union as a whole which has 2.5. Norway has the world's sixteenth largest reserves. All figures in trillion m3.

Of the world's total estimates for gas-reserves some 40 trillion m3 (22%) are slate-gas. India and China together have 20 . The USA has 10 and Europe 4 .

In Europe, Poland, Germany and Sweden are the most interesting countries in respect of the extraction of slate-gas though Belgium, Austria, Hungary, Italy, France and Switzerland all have significant potentials.

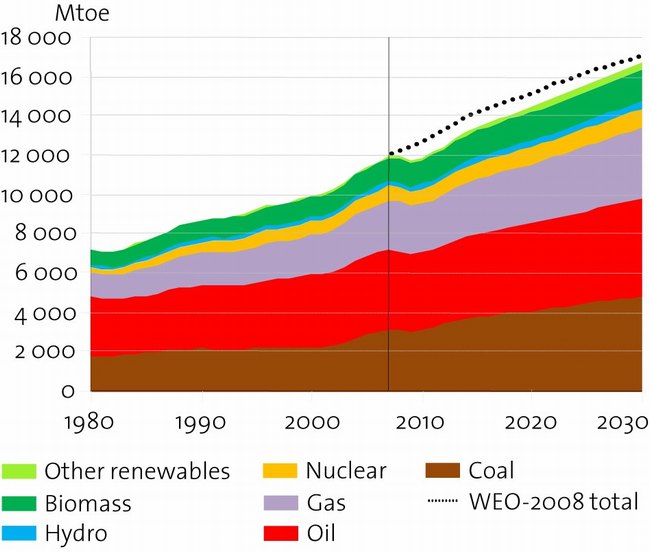

Figure provided by The International Energy Agency

Snøhvit, Goliat and Shtokman are the known gas-potentials of the High North. While Snøhvit and Goliat are less than 200 km offshore Shtokman is some 500 km offshore. Production at Shtokman is planned to start in 2016 but it may be further delayed. Map by Johanna Roto Nordregio.

By Odd Iglebaek