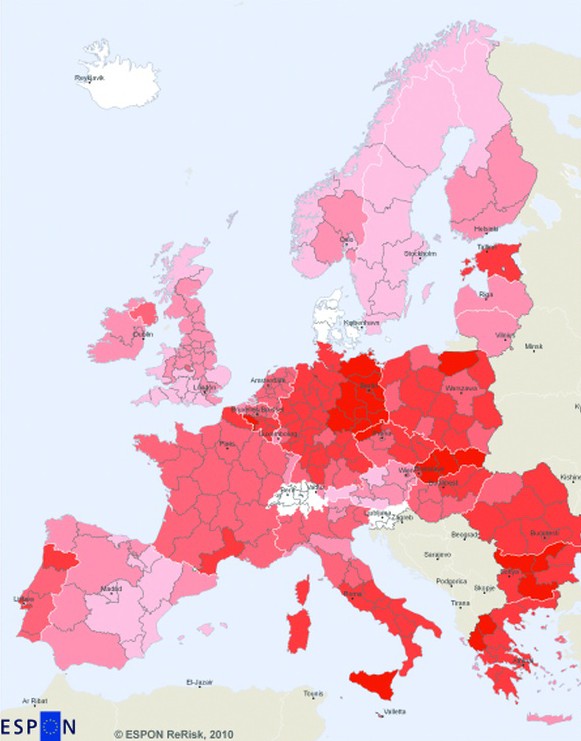

In the ReRisk project the regions' vulnerability to rising energy prices is tracked across three dimensions:

In the ReRisk project the regions' vulnerability to rising energy prices is tracked across three dimensions:

• Economic vulnerability, mainly due to regional specialisation in industries with high energy spending.

• The regions' dependence on (motorised) transport, both in terms of employment and transport uses.

• Social vulnerability, which refers to the segments of the population that may have problems paying their energy bills.

Differences in regional vulnerability are derived mainly from climate conditions, the economic and transport structure and the social situation in regions and cities.

On the demand side, responses to increasing energy prices in the short term have proven to be very limited. Price increases in the past have generally been too minor and too slow to have provoked changes in consumption patterns.

On the demand side, responses to increasing energy prices in the short term have proven to be very limited. Price increases in the past have generally been too minor and too slow to have provoked changes in consumption patterns.

However, adjustments to demand in the medium and longer term can be accelerated with the right policy measures and with investments in energy efficiency, thus mitigating the expected negative impact of rising energy prices on the main economic variables and the most vulnerable population.

So, what do we know about the possible impacts of rising energy prices in the regions? The impacts in economic terms can be estimated by identifying the industries with the highest energy spending and by determining which regions are specialised in these economic activities.

Specialisation means that a considerable proportion of employment and/or wealth creation in the region depends on these industries. Our analysis shows that the negative effects on regional economies are not limited to industries which are known to be energy-intensive, such as paper or aluminium, but also affect other sectors, for example the food processing industry.

Specialisation means that a considerable proportion of employment and/or wealth creation in the region depends on these industries. Our analysis shows that the negative effects on regional economies are not limited to industries which are known to be energy-intensive, such as paper or aluminium, but also affect other sectors, for example the food processing industry.

Inefficient industrial processes

Important differences exist between the EU countries with regard to industrial energy spending. Most of the Eastern European countries spend rather more on energy purchases (in terms of cost per unit of energy) across a number of industrial sectors, while in Western Europe, Luxemburg has particularly high energy costs.

These differences cannot be explained entirely by the levels of energy prices or general price indexes, so it must be assumed that energy is not efficiently used in some industrial processes.

These differences cannot be explained entirely by the levels of energy prices or general price indexes, so it must be assumed that energy is not efficiently used in some industrial processes.

The available data on industrial energy consumption seems to confirm this hypothesis. We find that, after Bulgaria, Romania is the country that employs the largest amount of energy per million € of industrial gross value added (16.06 TJ), followed by Latvia (12.46 TJ), Luxembourg (10.10 TJ), Estonia (9.17 TJ) and Cyprus (5.80 TJ).

The question is then whether these findings on national industrial energy consumption can be extended to the regional level. The analysis of industrial energy consumption in regions in France, Germany, Italy and the UK confirms that there is a positive correlation between the regional specialisation in industries with high energy costs and their actual energy consumption.

Highest economic vulnerability

The regions with the most unfavourable position in terms of economic vulnerability (>10% of employment in industries with high energy spending) are located in the Czech Republic and in Italy. In the latter case, the highly vulnerable regions combined represent more than 50% of industrial employment. However, Italian industries do not perform badly in the EU comparison with regard to energy spending, despite the relatively high energy prices in the country.

In the second group of regions, in which 7-10% of employment depends on industries with high energy purchases, we find some belonging to countries that fare worse in the EU comparison of industrial energy purchases: Romania (Centru), and Hungary (Észak-Magyarország and Dél-Alföld ), as well as Estonia and Latvia.

Unfavourable industrial structures

By combining the results on industrial energy spending and regional wealth creation and employment, it is possible to identify those industrial processes which should be subject to an in-depth analysis on the regional level because they are inefficient at using energy. Some suggestions can be given for the regions with the most unfavourable industrial structure in Italy, the Czech Republic and Hungary.

Italy

In the Italian regions of Emilia-Romagna, Lombardia, and Veneto, special attention should be paid to the manufacture of cement, since energy purchases in this sector represent more than 30% of total purchases and energy spending is almost 10% higher than the EU average.

A second critical sector is the manufacture of glass fibres, in which more than 18% of purchases are dedicated to energy, and energy spending is 8.6% above the average level of spending in the EU.

The sector encompassing the manufacture of other non-metallic mineral products, to which both cement production and the manufacture of glass fibres belong, employs more than 30 000 people in Lombardia and Veneto and more than 46 000 in Emilia-Romagna. Although cement production is regionally oriented and is therefore less exposed to international competition, improving efficiency would help to reduce the elevated level of industrial energy consumption in these regions.

Czech Republic

In the Czech region of Severovýchod production processes in the sector of other non-metallic mineral products should be analysed, since energy spending in this sector is 10% above the EU average on the national level and local companies in this branch employ 21 564 persons.

Moravskoslezsko also has a very high level of employment (28 388 persons) in the basic metals industry. Special attention should also be paid here to processes related to forging, pressing, stamping and roll forming of metal; powder metallurgy, for which energy spending is about 5% higher than the EU average and represents 7.65% of total purchases. Additionally, Moravskoslezsko ranks first with regard to wealth creation in sectors with high energy-spending, with more than 25% of regional GVA (Gross Value Added) coming from these industries.

All of the above-mentioned regions in the Czech Republic (Moravskoslezsko, Strední Morava, Severovýchod, Severozápad and Jihovýchod) should analyse the performance of one branch subsector of the chemical industry, manufacture of industrial gases, since energy spending is 10% above the EU average and energy represents close to 20% of total purchases. Employment levels in the chemical sector range from 4 225 in Moravskoslezsko to 7 943 in Severozápad.

Hungary

In the case of Hungary, decision-makers from Észak-Magyarország should take a close look at the manufacture of fertilizers and nitrogen compounds, since, on the national level, this industry spends 40% more on energy purchases than the EU average for the industry and energy purchases amount to almost 60% of total purchases. Észak-Magyarorszá ranks second among the Hungarian regions in employment in the chemical sector (6 215 employees), after Közép-Magyarország with 15 073 employees.

Carbon leakage

Differences in energy spending with regard to Europe are also considerable in the manufacture of starches affecting in particular the region of Dél-Alföld, where 25 444 persons work in the food-processing industry.

The data collected here makes it possible to identify potential weaknesses in regional economies derived from higher than average levels of energy spending and thus sheds some light on the hitherto obscure question of industrial energy use in the European regions.

The methodology can also be employed to add information on the risk of "carbon leakage", i.e. the possibility that companies decide to transfer activities to countries outside the EU if production costs rise as a result of carbon taxes [EC 2009b].

Carbon leakage seems to be a major threat to the Belgian provinces of Brabant Wallon and Antwerpen, which should analyse the situation in the sub-sectors dealing with the manufacture of other organic basic chemicals as well as fertilizers and nitrogen compounds, since these spend more than the EU average on energy purchases.

The British regions of East Yorkshire and Northern Lincolnshire may also be exposed to the risk of carbon leakage by companies dedicated to the manufacture of other inorganic basic chemicals, which do not perform well with regard to the sub-sector's average spending on energy.

Within the two countries most affected by the risk of carbon leakage, Poland and Finland, two specific problem regions can be identified: Swietokrzyskie, with 21.24% of industrial employment in sectors facing the risk of carbon leakage and Pohjois-Suomi (where 34% of industrial employment is in the critical sectors).

Transport dependence and social vulnerability

To measure transport dependence, several attributes have to be taken into account such as employment in the transport sector, commuting, the cost of freight transport and the need for air travel in remote regions and islands.

Differences among EU regions are considerable in each of the above-mentioned categories. The combination of transport indicators reveals that the most vulnerable regions are the large logistics centres, peripheral and island regions, but some rural regions are also dependent on working opportunities in nearby urban poles or agricultural regions with high export levels.

The costs of commuting or those associated with other car uses directly affect the budget of households, while increased costs for freight in the region will affect the general price level of goods, with further negative effects on available income.

Additionally, households will have to face higher heating and electricity bills, such that the total energy expense may become a serious burden for families already struggling to make ends meet. This is the third dimension of 'energy poverty' that was analysed in the ReRisk project.

The current economic crisis is already having an effect on the energy sector. The Italian electricity company Enel for example, reports that the number of customers who cannot pay their bills rose during 2008, to 600 000 (up 30% since 2007). This is not so much because of rising energy prices, but rather due to declining incomes, though the effects are similar.

Social vulnerability is obviously strongly related to the levels of poverty in the regions. Despite the importance of this problem no indicators are available to measure the risk of poverty in the regions directly. People slide into poverty in different types of circumstances and long-term unemployment and low rates of economic activity are considered to be the main reasons for this. In 2007, 16 regions in Europe, plus the French overseas territories, had a long-term unemployment rate above 60%.

The list comprises a number of regions in Eastern Germany, as well as three regions in Bulgaria and two of the four Slovakian regions: Stredné Slovensko and Západné Slovensko.

Activity rates below 50% are frequent in the Southern regions of Italy, and in four regions in Hungary: Észak-Magyarország, Észak-Alföld, Dél-Alföld and Dél-Dunántúl. Severozapaden in Bulgaria also belongs to the group of regions with the lowest levels of economic activity (less than 43%) with another two regions from this country (Severen tsentralen and Yuzhen tsentralen) following closely behind.

Rising energy prices are bound to become a serious social problem in the area, which extends from Eastern Germany to the New Member States, especially those with very low disposable incomes, such as Bulgaria, Romania, Hungary and Poland. Energy costs represent a much greater strain on household budgets in these regions, which in addition have a high demand for heating in the winter time.

By Daniela Velte, Senior Researcher, Tecnalia