This is how Thomas Hanell and Jörg Neubauer summarise what they call the 'Geographies of Knowledge Production in Europe', published as Nordregio Working Paper 2006:3. The paper was prepared for the conference 'Investing in Research and Innovation' and was well received. The conference, held in Copenhagen, was jointly organised by the Nordic Council of Ministers and the European Commission, Directorate-General for Research and Directorate-General for Enterprise and Industry on 16-18 October this year.

The EU's Lisbon agenda set the target of an R&D investment rate of 3% (of GDP) which was to be reached by 2010. During 2000-2003 the un-weighted annual average economic growth rate for regions where R&D spending exceeds 3% of GDP was 2.2% per year on average.

– However, as Hanell and Neubauer note, for those regions where R&D spending was below this 3% target limit, the corresponding economic growth rate was 2.3%, i.e. higher.

Europe modest on R&D

Today a rather modest share – when compared to the US or Japan – of 1.9 % of the EU25's GDP is spent on R&D. In the USA and Japan however, expenditures are mainly allocated to experimental development while the EU25 tend to focus in general on applied research. In absolute terms, expenditure on R&D has, with the exception of the last five years, seen a steady growth.

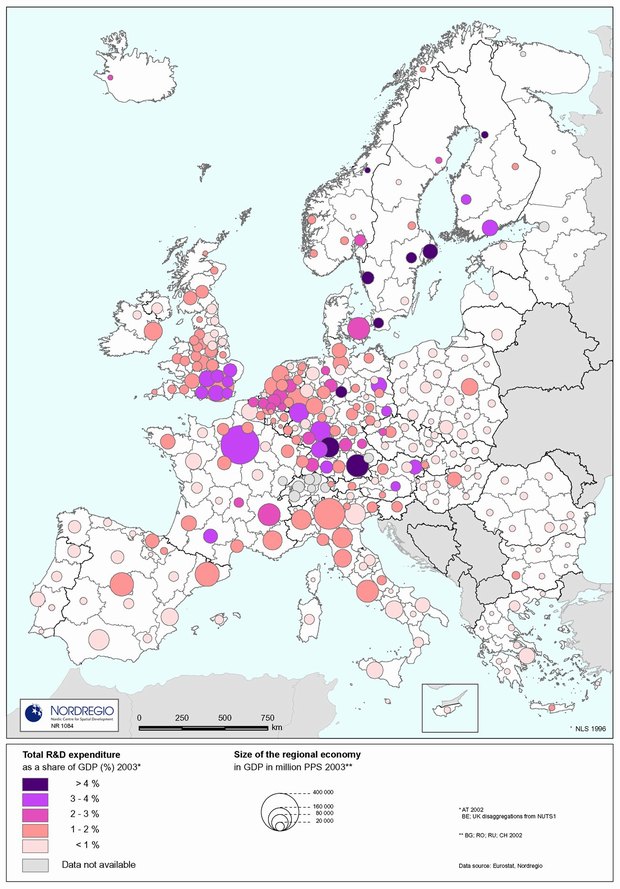

The lion's share of Europe's R&D financing is spent in the core economies of Germany, France and the United Kingdom. In contrast, expenditures on R&D are generally low in Southern and Eastern Europe. On a national level currently only the Nordic countries of Finland, Sweden and Iceland meet the 3 percent EU expenditure target.

Strong concentration

Furthermore, the EU's overall investment in R&D is actually based on the expenditure of only a few regions, all of which are located in the EU15. The top positions are dominated by German and Nordic regions led by Braunschweig (8.7% of GDP spent on R&D). In the New Member States (NMS) the most R&D intensive region is Stredni Cechy (2.6%) surrounding Prague.

Research investment is thus highly concentrated within the European Union and EEA countries with 30% of all R&D investment concentrated in only ten regions, these ten regions account for a mere 12% of the corresponding population.

Moreover, R&D funding varies significantly from region to region within countries. Finland and Germany are good examples of this. Other larger regional disparities in funding intensity are for example to be found in Norway, Sweden, the UK, the Czech Republic and Poland.

The major part of the EU25's R&D expenditure stems from the business sector (54%), two thirds of which is spent in manufacturing and one third in services. This is, however, modest compared to the USA, Japan or China.

The private sector dominates R&D investment especially in the EU15 with the exception of Austria, Greece, Italy, Portugal, Spain and the UK. In Luxemburg, Finland and Switzerland already today more than two thirds of R&D expenditure originates from the private sector.

The governmental sector (35%) is the second major contributor in the EU. Compared to the other world economies this percentage remains rather high. The public sector dominates in the New Member States, except for the Czech Republic and Slovenia, and in the cohesion countries. The Russian Federation also finances most of its research from governmental sources, while Norway and Iceland fall in between the two extremes as, financially, the R&D 'spend' is roughly balanced between the private and the public sectors.

The remaining R&D expenditure originates from other (third sector) national sources (2%) and from a comparatively large and increasing share from abroad (9%). The latter sector is particularly evident in Austria, Latvia, Malta and the UK, where every fifth Euro invested in R&D comes from abroad.

In the Nordic countries domestic financing predominates, except for Iceland where 14% of R&D financing comes from outside the country. The situation in Iceland is thus nearly on a par with that in countries who receive substantial Foreign Direct Investment, such as Estonia, Lithuania and Cyprus.

Total R&D expenditure as a share of GDP 2003.

By Tomas Hanell and Jörg Neubauer