Since the Nordic electricity market was first formed the focus on climate change and the environmental aspects of energy production has significantly intensified. Today the emission of greenhouse gasses is one of the central issues in the energy discussion, second only in importance to the security of supply. This creates opportunities for and challenges to the Nordic electricity market.

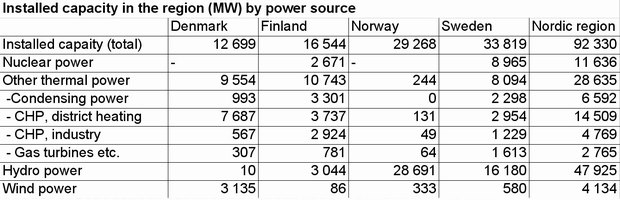

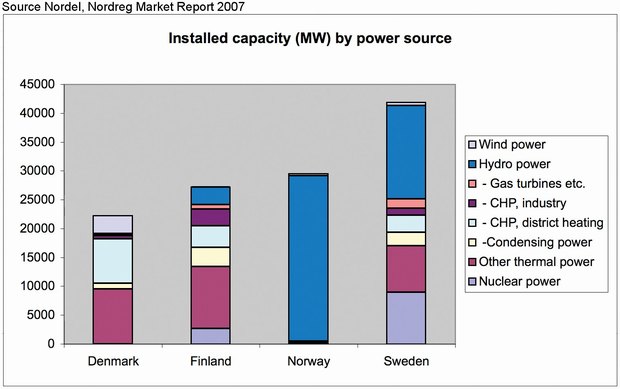

Fossil fuel usage still predominates in the Nordic energy mix while linkage to the European electricity grid also sees a further influx of fossil-based energy in the Nordic region. This ensures that the electricity price in the Nordic region reacts to market signals in respect of the increased costs associated with fossil-fuel based energy production. This cost reaction is quickly 'passed on' by the energy companies to their customers. In this context, Nordic governments appear to have an additional incentive to increase the share of renewables in the Nordic energy mix even further. The total installed capacity in the Nordic market, in 2007, was 92 330 MW (see figure 1). With the combined climate and energy goals of the Nordic countries, the region could however become a substantial exporter of 'clean energy' before 2020.

All the Nordic governments have com-mitted themselves to increasing the share of renewables in their national energy mixes in the coming years. EU targets in this respect place significant commit-ments on its members Denmark, Finland and Sweden. In addition, the Norwegian government recently announced that it will ratify the RES directive – thus subjecting Norway to the EU's binding renewables targets.

Increasing usage of renewable energy approaches in the energy system does however pose a number of challenges to the electricity market, most notably to the grid – as the transmission capacity needs to increase in line with the increased flow of energy. Building cables and transmission lines is a lengthy, unpopular and expensive process that needs to be taken into account when sites for renewable energy are chosen, and when the timeframes for implementation are being drawn up.

Electricity from renewable sources such as wind in addition displays a number of characteristics which increase the need for cross border inter-connectors. The electricity derived from wind power fluctuates – meaning that while there is plenty of electricity from wind when the wind is blowing; there is no electricity when there is no wind. Hydro power is a good source of balancing power in this respect. The grid thus needs to be expanded so that the fluctuating sources of energy can be balanced. If this is not done, congestion, failures and blackouts in the Nordic market will undoubtedly increase with wholesale adoption of renewables promotion.

As a whole, the Nordic market has already come a long way in terms of grid expansion. As noted above, new grid investment is expensive, and should not be undertaken when it is not socio-economically viable. The socio-economic calculations need to be made with the entire Nordic market in mind in order to attain the best result. This is the task of the Nordel Planning Committee.

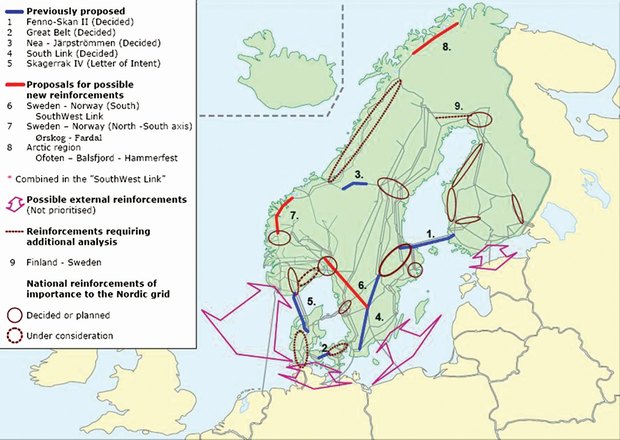

In March this year, Nordel presented their Grid Master Plan 2008, which contained the organisation's recommen-dations for grid investment in the coming years. The plan builds on the five previously proposed and prioritised grid investments:

• The southern link between central and southern Sweden.

• The Great Belt Link in Denmark.

• The new Fennoskan 2 Link between Sweden and Finland.

• The new Nea-Järpströmmen Link between Norway and Sweden.

• The new Skagerrak Link between Denmark and Norway.

Based on the realisation of the abovemen-tioned five investments, Nordel also proposes three new investments (See figure below):

• The Ørskog-Fardal link in Norway

• The South-West link between Norway and Sweden (and between mid and south Sweden)

• The Arctic link (in Norway)

It is vital for the Nordic market that these investments are undertaken as soon as possible.

Parallel to the development of the Nordic grid, the national TSOs are also furthering their interconnector capacity to the continent, and hence increasing the power flow into the Nordic grid. The increased flow of power however further necessitates the need for a common Nordic solution to congestion manage-ment.

One of the crucial areas where further integration of the Nordic electricity market is possible is in the end-user market. According to NordReg, the Nordic association of regulators, there are substantial benefits if the integration of best practice solutions from across the Nordic countries can be built upon.

In 2005, NordReg announced the vision of a common Nordic end-user market by 2010. Though this goal may seem a little ambitious by 2010, it is this kind of vision that has made the Nordic market an example for others to follow.

By Amund Vik, Advisor, Nordic Energy Research

TSO = Transmission system operator: Statnett (NO), Svenska Kraftnätt (SE), Energinet.dk (DK) and Fingrid (FI). The national TSOs cooperate in the Nordic market through their organisation Nordel

Nordel is Nordic cooperating institution for the TSOs. Through Nordel, the TSOs cooperate on balance management, congestion management, peak load arrangements and investment planning. The regulation counterpart of Nordel is NordREG, the regulators' Nordic institution.

Nordel is a cooperative, unanimity-based organisation.

For more information on Nordel, see www.nordel.org